How Accurate Tax Filings Can Be Your Key

File your 2023 Tax Returns with Confidence and Purpose

Buying your first home is an exciting but potentially daunting journey. Securing a mortgage is a crucial step, and your tax returns can be a powerful tool to help you achieve your dream. Not only do they act as proof of income, but they also influence key factors lenders consider, like your debt-to-income ratio and creditworthiness. Let’s explore how staying on top of your taxes can give you a leg up in the homebuying game:

1. Showcasing Stability: Lenders need assurance that you can reliably make mortgage payments. Accurate and timely tax returns serve as a detailed record of your income history, revealing consistent earnings and responsible financial behavior. This builds trust and strengthens your application.

2. Calculating Affordability: Your debt-to-income ratio (DTI), calculated using information from your tax returns, determines how much mortgage you can qualify for. Having your tax information readily available ensures an accurate DTI assessment, leading to a pre-approval that reflects your true borrowing power.

3. Boosting Your Credit Score: Responsible tax filing demonstrates financial discipline, a key factor in building a strong credit score. Timely tax payments and filings positively impact your score, potentially unlocking lower interest rates and better loan terms.

4. Highlighting Hidden Assets: Your tax returns provide a snapshot of your financial picture, including assets like investments and retirement accounts. These can serve as potential down payment sources or security for your loan, showcasing your overall financial strength.

5. Maximizing Savings: Owning a home comes with tax benefits like the Mortgage Interest Deduction or the First-Time Homebuyer Credit (where applicable). Accurate tax filing ensures you claim these deductions and credits, reducing your tax burden and making homeownership more affordable.

Remember: Consistency is key. Maintaining organized and accurate tax records throughout the homebuying process demonstrates your commitment and responsibility. If you’re a first-time homebuyer, consider seeking guidance from a tax professional or financial advisor. They can help you optimize your financial situation and leverage your tax returns for a smoother and more successful mortgage application.

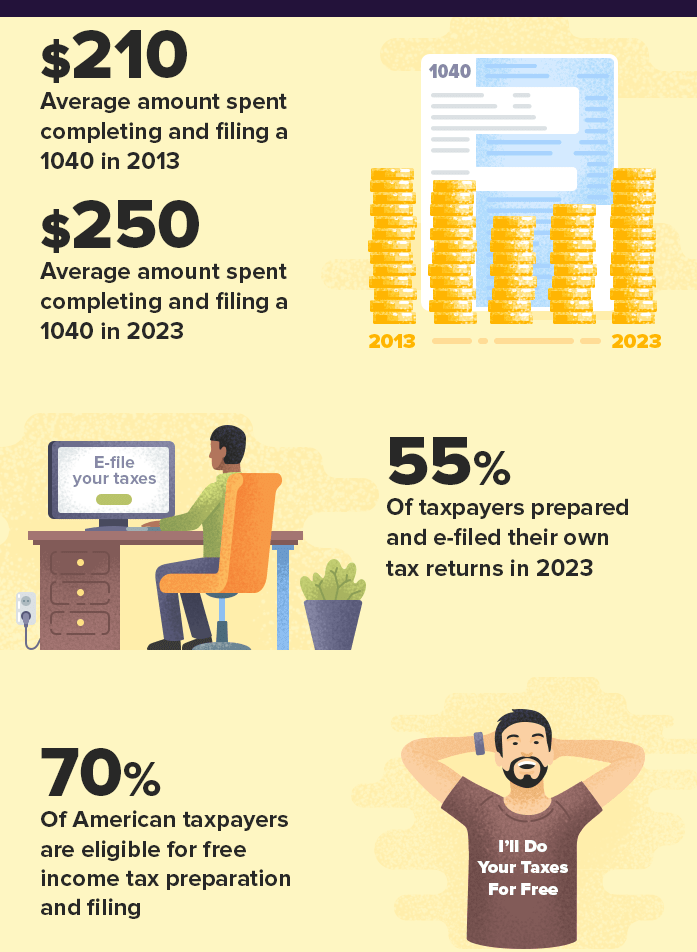

Start paving the way to your dream home today! By prioritizing accurate and timely tax filings, you unlock a valuable tool that can empower your homeownership journey. Checkout our FREE tax filing services.