Pre-Purchase Education & Counseling – OLD

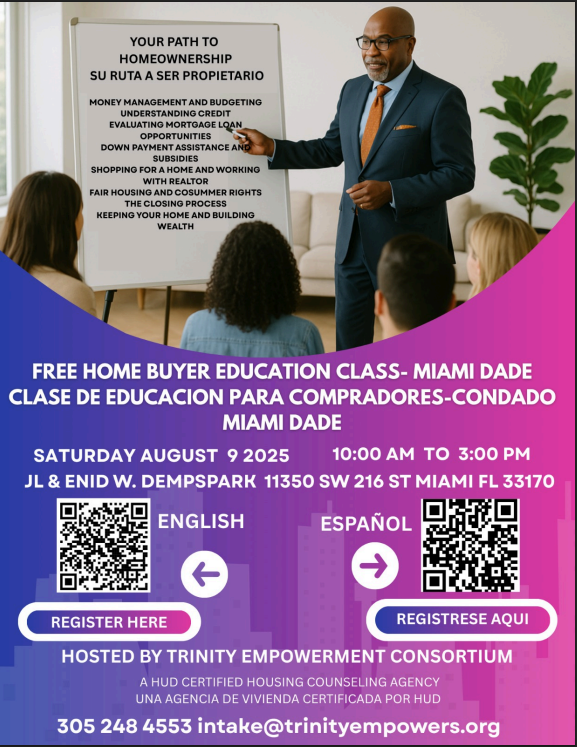

Pre-Purchase Education

& Counseling

& Counseling

The goal of group homebuyer education is

to provide an overview of the home buying process.

![]()

Money Management & Budgeting

Module Objective - At the conclusion of this segment the participant should be able to calculate a budget by reviewing their spending patterns. The budget should be realistic and enable them to meet their financial goals.

![]()

Understanding Credit

Module Objective – Participant should understand how credit is utilized in the homebuying process, what is the minimum score required, what can I do to improve my credit and what are the best strategies to maximize my score.

Obtaining the Best Mortgage Product

Module Objective – At the conclusion of the program the participant should be aware of the different types of mortgage products available and down payment assistance for which they may be eligible.

![]()

Shopping for A Home – Working with a Realtor

Module Objective – Working with a Realtor is not mandatory but generally helps simplify the process if you choose a realtor who is knowledgeable in the types and location of homes you are interested in. This section helps prepare the participant for the interviewing process as it relates to realtors, as well as provides insight on the types of services a realtor generally provides.

![]()

The Closing & Beyond

Module Objective – Helping to Manage the expectations of the participant from the time they receive the fully executed contract until they receive the keys to their new home. This period of time known as Escrow is fraught with stressful activities i.e. Inspections, Moving, Insurance, and mortgage approval. Also included are preliminary post-purchase information including home maintenance and estate planning.